1031 Exchanges – Expand Your Knowledge

Live Class Tuition: $55

Live classroom tuition includes: complimentary water, copy of a general warranty deed, highlighters, and pencils.

Please read the important course information under the list of available dates.

THIS COURSE IS NOT YET APPROVED FOR CONTINUING EDUCATION CREDITS.

Dates Coming Soon

This is held as a 2 Hour Class

8pm – 10pm or as noted above

The 1031 Exchanges – Expand Your Knowledge is an elective course that can be taken by potential customers such as potential buyers looking to buy real estate property, investors, and industry professionals wishing to brush up on their knowledge and leave with a clear understanding of the different tax advantages for investors. In this course the real estate instructor will go through the rules for 1031 exchanges and the different situations where they might be or might not be useful.

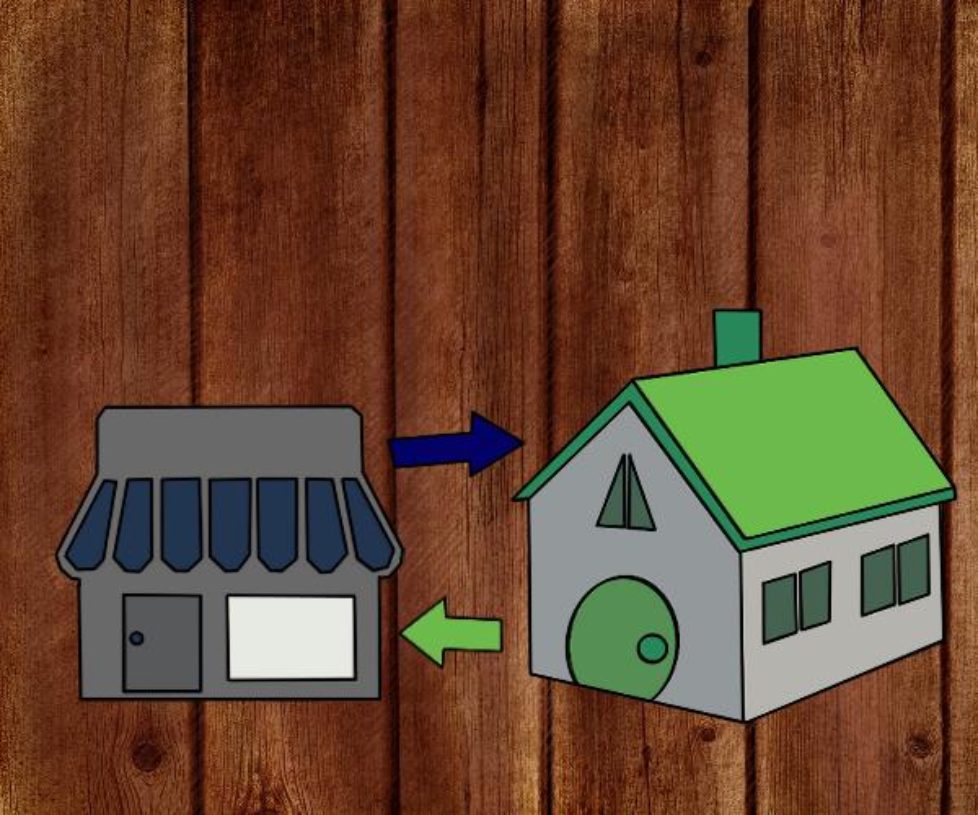

1031 exchanges provide investors with one of the best tax strategies for preserving the value of an investment portfolio. By using an exchange, the investor is able to defer capital gain taxes that would otherwise be incurred on the sale of the investment property. The investor can then use the entire amount of the equity to purchase substantially more replacement property. To qualify as an exchange, the relinquished and replacement properties must be qualified “like-kind” properties and the transaction must be structured as an exchange.

Topics covered in this course include:

• 1031 Tax Deferral Strategies guidelines and rules

• How to earn multiple commissions instead of one

• Benefits and Reasons to Pursue a §1031 Exchange

• How to 1031 Exchange Vacation Homes and Second Homes

• Amendment to the Primary Residence Exclusion and §1031 Exchange

• Growing your business and Clients Wealth

THIS COURSE IS NOT YET APPROVED FOR CONTINUING EDUCATION CREDITS.